If you're a globe-trotter and are looking for a solution to manage your money while traveling, Wise's multi-currency account is made for you.

Whether you're an expat or a traveler, Wise will help you save money on your trips.

And for a few months now, money held in EUR, GBP and USD accounts can earn interest!

For eligible balances held in Wise accounts in February 2025, Wise paid an annualized rebate rate of:

- 1.40% for EUR;

- 2.80% for GBP;

- 2.80% for USD.

See: How do balance rebates work?

Wise is becoming even more interesting as European governments are talking about taking their citizens' savings to finance their defense.

Menu

Bankers love travelers!

Whether you're a traveler or an expatriate, you often find yourself having to use your bank card to pay or withdraw money abroad, and what hurts the most is the withdrawal fees charged by Western banks.

And these withdrawal fees or card withdrawal commission in addition to the exchange rate always in favor of banks, are a real scandal denounced by Wise:

“Hidden bank fees would cost French people nearly 2 billion euros.

Certain transactions, such as expenses during vacations outside the euro zone, are heavily penalized by banks ».

International money transfers would cost nearly 2 billion euros per year to the French, according to a study published on May 23 by Wise (Transferwise).

Based in London, this company presents itself as a specialist in international money transfers.

Demanding more transparency from banks, it aims to denounce the hidden fees they apply to the detriment of consumers. »

See the full article on Le Monde.fr

Multiple solutions, but many scams

I've already discussed some solutions for managing your money while traveling and other online banks in the article:

Money in Thailand, bringing cash or withdrawing from ATMs

What you need to know is that a few banks offer cards with fee-free withdrawals abroad, but they charge huge conversion fees, and in the end, they cost more than Wise, but without users realizing it.

This is what was denounced during the major donation campaigns for Ukraine.

Journalists had discovered that Wise was the only bank that charged a minimal exchange rate on donations, but after investigating further, they realized that other banks were making a lot of money on the exchange rate, they were profiting from the conflict without the donors noticing.

Transfer, exchange, and withdraw money at lower fees

Wise is first and foremost a platform that allows you to transfer money internationally from one account to another with a very low commission.

With over 16 million customers worldwide moving over 10 billion euros every month, they have become a reference in the field.

Wise also offers a product that is in line with its service: a multi-currency bank account.

With this account, you get international bank details instantly to receive money worldwide with zero fees.

This means you will get:

- An Australian account number and BSB code

- A British account number and short code

- A European IBAN

- An account number and US routing number

- A New Zealand account number

These are your personal details to get paid from the UK, the US, Australia, New Zealand and any eurozone country, without fees.

Wise allows you to hold money in more than 40 different currencies.

And, you can send money to over 160 countries.

You can convert your money easily and at a very good rate.

Spend at the real exchange rate.

Your multi-currency account includes the Visa Wise debit card to spend in over 40 currencies and in over 150 countries, with no hidden fees.

- Free to pay with the currencies of your account

- 2 free withdrawals up to £200 per month, then they charge 1.75%

- Automatic currency conversion at the real exchange rate

- You only pay small conversion fees, between 0.35% and 2%

What I like about Wise

It is easy to manage different currencies, and it's good to know that they have one of the best exchange rates.

The account has some nice options; you can easily create "safe boxes" in the chosen currency, which means that the money you put in them cannot be withdrawn in case of data theft.

You can also freeze your card to prevent anyone who has stolen your data from making a purchase; personally, I keep my cards frozen permanently.

I thaw them before going to the ATMs or making a payment online.

You can easily create multiple virtual credit cards to pay online and destroy them afterwards.

After making an online purchase, I froze my card and then realized there had been 3 additional withdrawal attempts, so I deleted the card…

On your mobile, you will also have access to an application to track your expenses per month, classified by categories: shopping, bills…

You will easily see where you spend the most, a good help to manage your money.

They also have a very good customer service, efficient and fast, and few banks have as many positive reviews on Trustpilot.

Example of use

Managing your money while traveling: Expatriate

I have a salary or pension in euros, I transfer money from my French bank to my Wise account for free.

I open a baht account on Wise (it's very easy).

I then exchange euros for baht at the best rate, if the euro rate has fallen, I can ask that the exchange only be made when the baht has reached a certain level.

Yes, it's a very useful new option, as the baht exchange rate fluctuates often, you can, for example, ask to exchange only when 1 euro is worth 38 bahts, this will be done automatically, no need to monitor the rate.

Once the exchange is made, I can easily and at a lower cost transfer the baht to my Thai bank account.

And there, the costly withdrawal fees are over…

See: How to open a bank account in Thailand?

Managing your money while traveling: Tourist

I'm traveling to Thailand, I want to be able to withdraw money at a lower cost from ATMs, with the Wise card.

Better still, I don't want to let the banks handle the exchange of my euros to baht when withdrawing, because it's always to my disadvantage, so I open a baht account on Wise (or in another currency depending on the country visited).

I convert the amount I need into baht, where I ask Wise to exchange the money when the euro is at a better rate (see explanation above, for expats), and when I withdraw in Thailand with the Wise card, the bank will use baht.

If you do the math, and since they have one of the best exchange rates, you will be a winner.

Wise: the best option for transferring money from France to Thailand

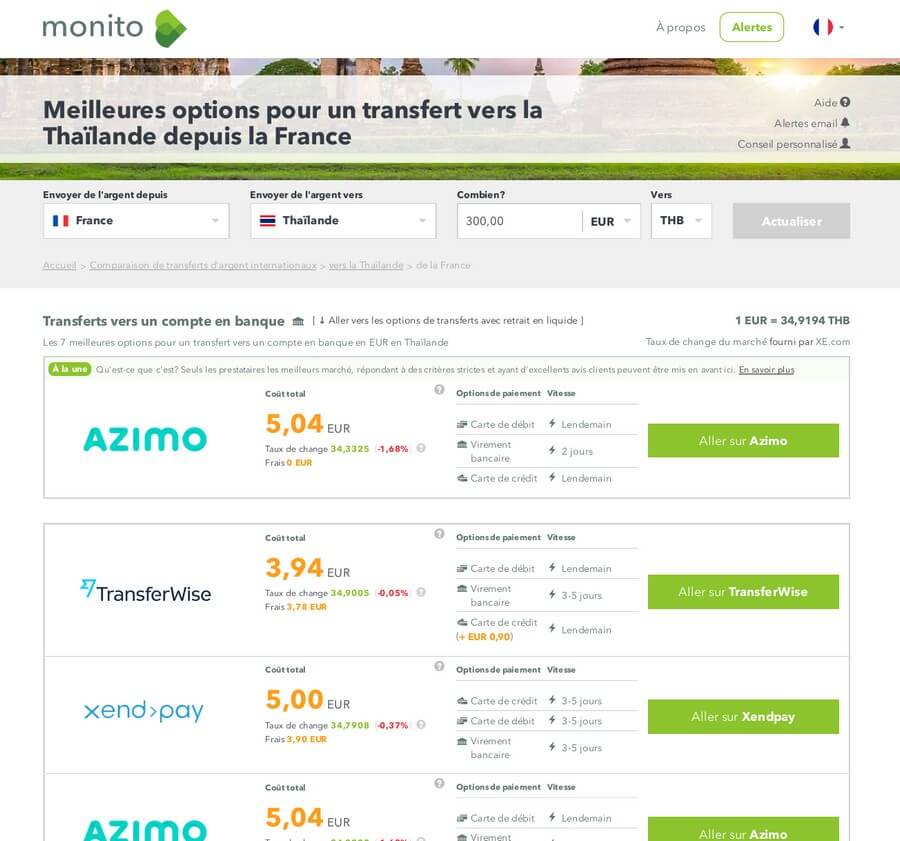

A new tool, Monito, allows you to compare the best solutions for transferring money from one country to another, and for Thailand, as for many other countries, Wise comes out on top:

The website: Wise.com

Do you like Toutelathailande.fr?

👉 Leave us a review on Trustpilot.

Your review strengthens the credibility of our work and the trust of our readers.

Useful links to prepare your trip to Thailand

Book bus, train and boat in Thailand

Manage your money while traveling with Wise

If our news, tourist information, or cultural content has been useful to you and you'd like to thank us:

You can follow us on:

Twitter, LinkedIn, Facebook,Google News

Or install our application: Install the application of All Thailand on your smartphone

12 comments

Thank you for this very informative experience sharing.

You can exchange your euros for baht on Wise, which is convenient, but not open a baht account with a number.

Try it, you'll see it's false.

This indicates that it's not yet available. (and it will never be given the difficulty of opening an account in Thailand).

But on the other hand, indeed, it allows you to change to baht at the desired time and keep the baht in your Wise account. (but not to have a number).

Hello Zinzin,

The advantage is being able to withdraw baht from an ATM or transfer baht to a Thai account.

Hello, when using a Wise card in Thailand, are we always scammed out of 220 baht or do we pay 30 baht like the Thais?

Hello Nico,

Everything is explained in the article, to avoid paying the tax on foreign bank cards, you need to open a Wise account and a Thai bank account, then you need to transfer your money from your bank to your Wise account (usually free), create a baht account on Wise and exchange your money into baht (the best rate), then you can transfer your baht to your Thai account and withdraw it for free from the bank's ATMs in Thailand.

Otherwise, yes, the Wise card will be taxed, like all foreign cards.

Hello,

I'm trying to send baht to a French account, but apparently Wise doesn't allow receiving money in baht (so not possible in the baht => euros direction).

Do you know a solution to this?

Hello Julia,

I've already sent baht from Bangkok Bank to my Wise account.

Then, if you want to send them to a French account, you need to convert them to euros on Wise.

Very good, we learn a lot of good things, keep going, I find this site excellent.

Best regards,

Mr. Aubertin Gilbert

Thank you for this comment Mr. Aubertin.

To what extent are WISE cards (physical or digital) accepted in Thailand?

Are debit card payment systems used everywhere?

Hello Frank,

Wise provides a physical Visa card accepted like all Visa or Mastercard cards at ATMs in Thailand.

The digital card is accepted by most merchants.

At first, some refused it, but today there is practically no problem paying with it.

Thanks!

We will land in Thailand in two weeks for three months.